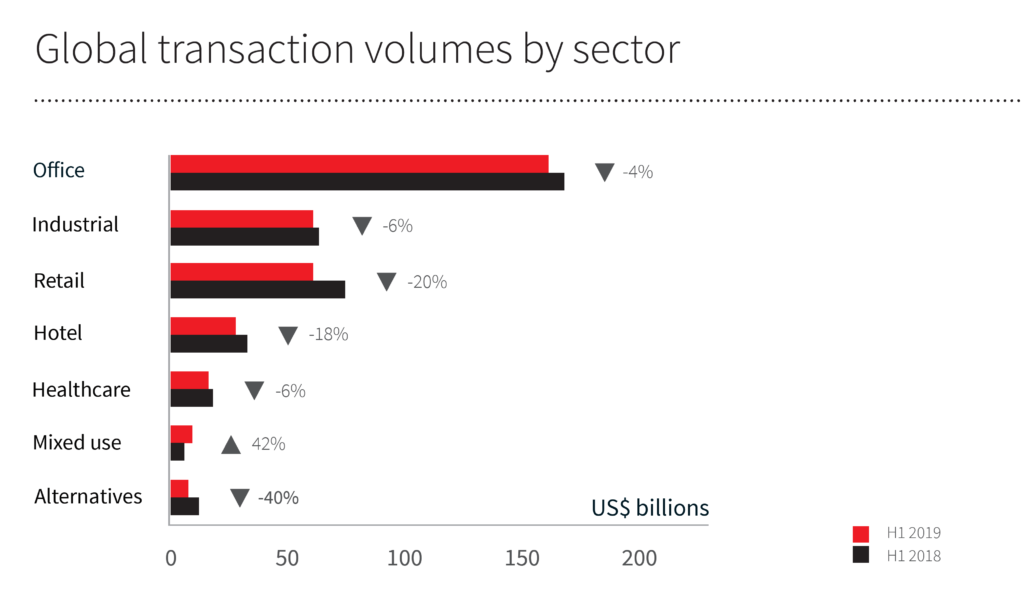

JLL’s research into global property transactions reveals that in the first half of 2019, there was a 42% increase in the value of mixed-use property transactions

JOHANNESBURG, South Africa, September 16, 2019/ — A new report from JLL the world’s largest professional services firm specialising in real estate, has revealed that people seeking to finance a new hotel project in Africa will be much more successful if their hotel is part of a mixed-use development.

JLL’s research into global property transactions reveals that in the first half of 2019, there was a 42% increase in the value of mixed-use property transactions, whereas there was a decline in other sectors, with Office down 4%, Industrial down 6%, Retail down 20%, Hotel down 18% and alternatives down 40%.

Xander Nijnens, Executive Vice-President, JLL Sub-Saharan Africa, explains that the trend is driven by lenders’ approach to risk. He said: “Diversifying risk by including alternative types of property, commercial, retail, hotel and branded residences, in one development, provides comfort to financiers due to the diverse and more consistent income streams generated. Branded residences are also increasing in prevalence because they provide up-front cash inflows and a more predictable source of revenue than one gets from a hotel alone.”

In Africa, the leading funders of hospitality construction projects are government-backed Development Finance Institutions (DFIs) like International Finance Corporation (IFC), Overseas Private Investment Corporation (OPIC), the CDC Group, Proparco and the German Investment Corporation (DEG). They are motivated by economic development, skills development and job creation and have a lower requirement for the predictable, consistent loan repayments required by a commercial bank. DFIs are also able to stomach more risk.

A driving factor for this trend is that hotels rent their rooms in euros and US dollars rather than in local currency which, from a financing perspective, reduces the risk to the lender and lowers the interest rate paid by the borrower.

The research comes a week ahead of the Africa Hotel Investment Forum (AHIF), Africa’s highest profile gathering of the hospitality and tourism industry, which takes place in Addis Ababa on September 23-25.