A report into the state of the tourism sector in South Africa has revealed the damaging effects by the novel coronavirus.

The survey was collaborative effort of the Department of Tourism in ‘Mzansi’ Land, the International Finance Corporation of the World Bank Group and South Africa’s Private sector umbrella body the Tourism Business Council (TBCSA).

It was titled: ”Tourism Industry Survey of South Africa: COVID-19” and themed on Impact, Mitigation and the Future

The report which unpacks the fulcrum of the sector interviewed 1,610 respondents involved in the sector.

Among other things, it highlights the dire situation brought by the deadly disease.

Result

”Before COVID-19, in February 2020, the performance and optimism around the South African tourism economy was relatively positive. 40% of responding firms claim they were growing, with a further 32% performing at a constant level. Most firms felt either neutral or positive about the future of their business and tourism in South Africa.

”After the first 6 weeks of feeling the impact of COVID-19, 99% of firms claim to be affected by the pandemic. Only 23% feel neutral or optimistic about the future.”

Tourism is one of South Africa’s most important sectors. Last year we received 10.4 million international tourism trips and tourism saw a total injection of R273.2 billion into the South African economy in 2018.

Tourism supports 740,000 direct jobs and over 1.5 million jobs across the economy.

The sector is the lifeblood for many micro and small enterprises, often the only economic activity in rural and remote areas, and creates employment opportunities for men, women and youth across the country.

The survey was a collaboration between IFC, Department of Tourism, and TBCSA and all its member associations.

It aims to quantify the extent of the impact of COVID-19, how effective the support has been, and what kind of help is still required.

We will survey the industry three times in total over the next 12 months to track progress.

Highlights

99% of responding firms are affected by COVID-19.

64% feel neutral or positively believe their business will survive to take part in the recovery.

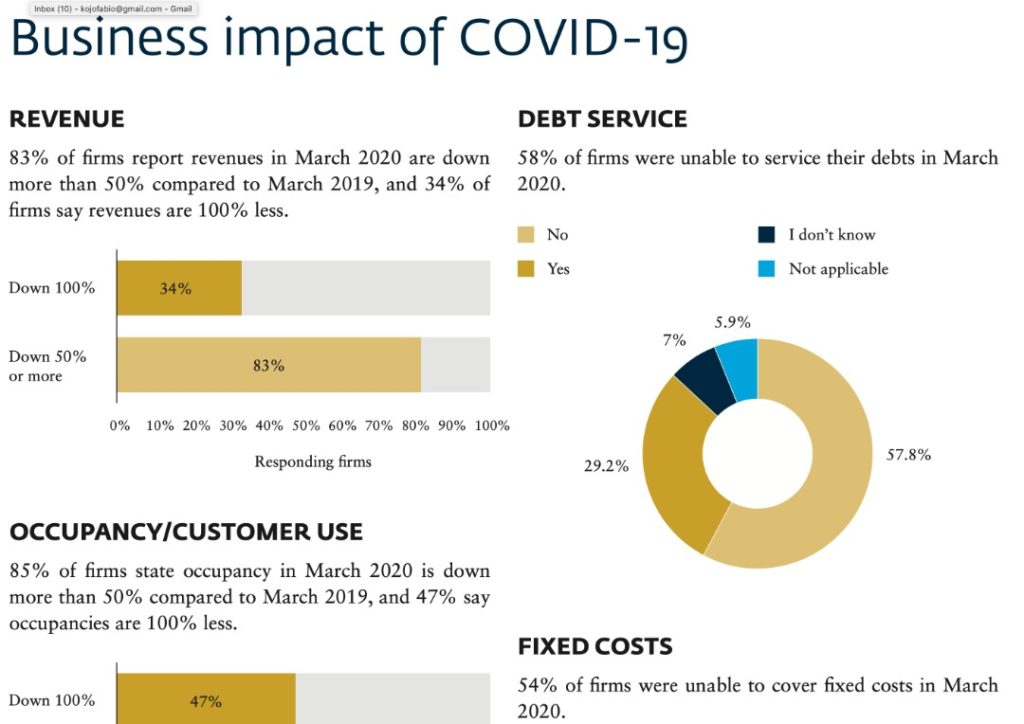

83% of firms report revenues in March 2020 are down more than 50% compared to March 2019, and 34% of firms say revenues are 100% less.

58% of firms were unable to service their debts and 54% of firms were unable to cover fixed costs in March 2020.

Firms so far report having managed their workforce in different ways, with most favoring reduced wages over furlough or redundancies. 50% of firms have reduced wages for more than 50% of staff, and 36% of firms have reduced wages for all staff. 11% of firms have made more than 50% of their workforce redundant, and 53% have not made any redundancies.

A greater proportion (75%) of medium businesses have reduced wages than small businesses, and a greater proportion (31%) of small businesses have applied redundancies.

The most commonly applied mitigation measures by businesses are temporary closure at 69%, supporting deferment instead of cancellation at 60%, and significant downscaling at 58%.

All businesses prioritized the need for financial support for cash flow, financial support for recovery, and tax relief.

Micro firms claim cash flow is their first priority, small firms prioritize financial support for recovery, and both medium and large firms prioritized tax relief.

The support facilities with the most respondent awareness are the UIF scheme and the Tourism Relief Fund of the Department of Tourism.

There has been strong uptake for all facilities, but success rates in these early days are uniformly low.

Respondent Profile Summary

1610 total respondents.

50% operate in the Western Cape, the remainder across the country.

66% are micro with 1 – 10 employees.

52% have annual turnover of R0 – 3m.

46% are accommodation providers, 20% are tour operators, and the rest split between activity providers, Meetings, Incentives, Conventions and Exhibitions (MICE), conservancy-related, community based, transport and other.

62% of firms are 10 years or older.

BEFORE COVID-19

79% felt neutral or optimistic about their business and the future of tourism in SA.