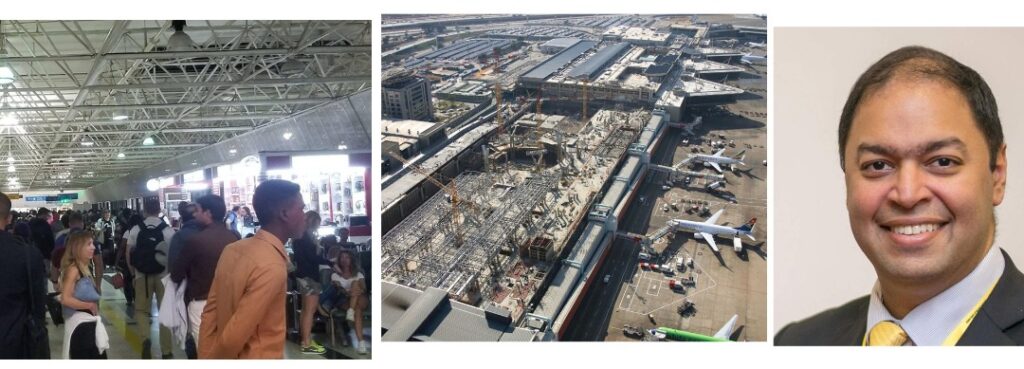

Africa represents 20% of the global land mass and 12% of the global population, but only 3% of global air traffic. While some may assume that this implies African consumers have shunned travel by air, others view this as an excellent opportunity to introduce the vast majority of the continent’s population to flight.

Africa lags the world in air transport volumes for numerous reasons, ranging from poor access to local capital to inflated costs for support logistics. However, the lack of a potential market is not one of these. The reality is that the vast distances of Africa, coupled with the absence of a strong road or rail-based ground transport network, make the continent perfectly suited for air travel.

It costs airline companies a lot more to transport a passenger in Africa than elsewhere in the world, due to the need to import everything from fuel to spare parts, as well as airports that only support 24-hour operations in a few urban pockets of the continent. Unfortunately, air travel in Africa has historically been viewed by Governments as a luxury product for the elite, and therefore as an easy target for disproportionately high taxes (both direct and indirect) and user fees. This ends up creating a vicious circle where only the elite are therefore able to afford air transport. Taxes and fees artificially inflate the cost of a flight journey significantly, often doubling the actual ticket price. As a result, demand for air transport is drastically depressed.

Economically, Africa is entering the “magic zone” where demand for air travel should grow at a rate double that of GDP growth. Around 40 of the 54 African countries are now classified as “lower middle income”, representing a per capita Gross National Income of roughly between $1000 and $4000. As consumers have increased amounts of disposable income, one of the first things they spend on is travel. As workers begin to value their time more, they are willing to spend more to travel faster. This is the value proposition that air travel brings to the new middle class in Africa.

A silver lining has been the growth of a new generation of consumers who should be ready to embrace the low cost carrier (LCC) model that has revolutionised flying in similar developing markets from Southeast Asia to Eastern Europe to Latin America over the last two decades. These consumers consist both of the newly economically empowered middle class, as well as millennials entering the workforce. They demonstrate more globalized consumer behaviour compared to existing flyers and consequently do not have expectations of expensive legacy product attributes from airlines such as generous checked baggage allowances or free in-flight meals.

An airline looking to compete in the Africa market today can either choose to embrace a legacy model where they will compete primarily with state subsidized airlines for a slice of the existing pie, or they can choose to put together a new set of ingredients and bake their own larger pie that suits the tastes of the emerging customer base. Passenger growth in Africa will come from the bottom end of the market over the upcoming years, and the airlines who can find a way to tap into that demographic successfully have nearly infinite potential for success.

Author:Sean Mendis

Sean Mendis has two decades of experience in senior management roles within the aviation sector in Africa. He is presently based in Malawi, where he offers executive level consulting and intelligence to aviation stakeholders.

This article was first published in the July 2022 Issue of VoyagesAfriq Travel Magazine