When it comes to travel and tourism, sub-Saharan Africa is a region with massive potential tempered by multiple structural, institutional, economic and socio-economic challenges. According to data from the World Travel & Tourism Council (WTTC), the region’s direct travel and tourism GDP is forecast to grow by 60% from 2018 to 2029. As such, the industry has a crucial role in the development of the region.

But to maximize future gains, regional economies will need to improve their competitiveness. The results of the 2019 edition of the Travel and Tourism Competitiveness Report (TTCR) indicate that the region has an enormous opportunity to take advantage of its abundance of natural resources and should build its competitiveness through its well-documented successes in increased connectivity.

Untapped potential

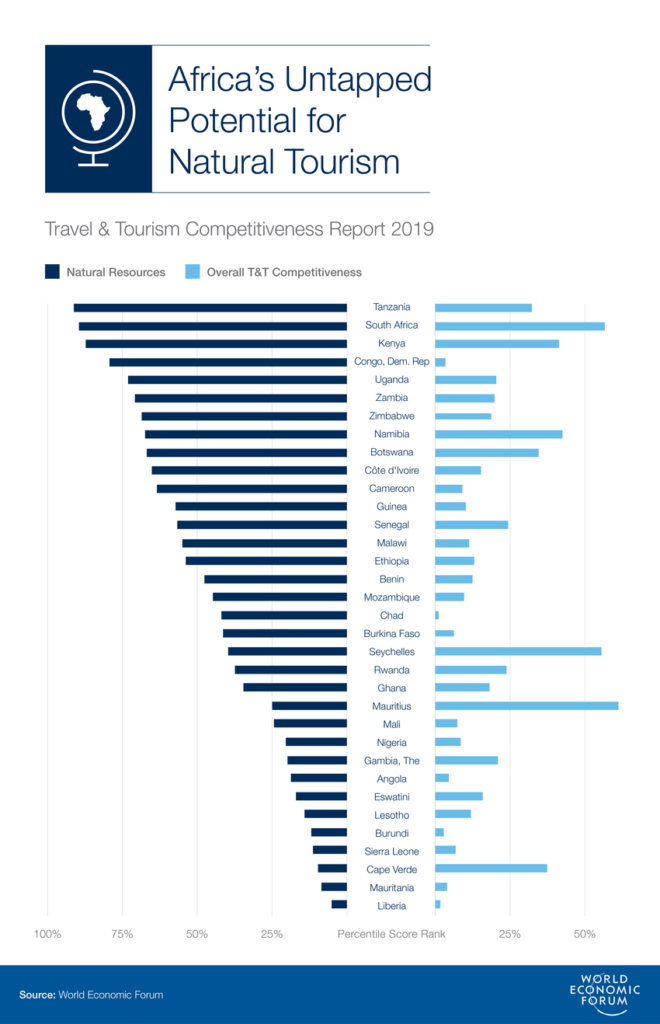

TTCR 2019 highlights what steps could be taken to better utilize sub-Saharan Africa’s rich natural resources to generate nature-based tourism. Nearly half of the 34 regional economies covered by the report are among the upper half of top scorers for natural resources, with Tanzania, South Africa and Kenya among the top 20%.

The region accounts for nearly 17% of UNESCO World Heritage Natural sites and, based on IUCN figures, on average countries in sub-Saharan Africa have nearly 15% more known species than others in the ranking. Despite this, the region is the least competitive in the world when it comes to travel and tourism, with only Mauritius, South Africa and the Seychelles ranking in the upper half of the Travel and Tourism Competitiveness Index (TTCI) scorers. Consequently, sub-Saharan Africa boasts a large gap between overall TTCI and natural resource scores in the ranking.

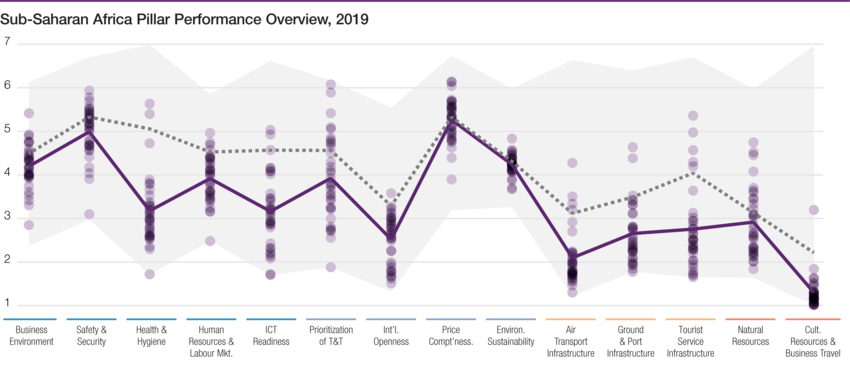

This gap is characterized by issues such as unfavourable business environments, health and hygiene concerns, low ICT readiness and severely underdeveloped infrastructure. In addition, despite the sector’s potential and importance to economic development, regional economies are yet to develop strategies to capitalize on this. This is shown in the typically low scores for prioritization of travel and tourism and overall international openness.

Even price competitiveness, one of the region’s strongest advantages, is in some cases diluted by fairly high ticket taxes and airport charges (making air travel more expensive), and hotel prices. These challenges make sub-Saharan Africa less likely to attract visitors and travel and tourism investors despite its appealing natural assets.

The findings of the TTCR 2019 offer two potential considerations for policy-makers and stakeholders involved in developing their travel and tourism industry strategies:

1. The range of challenges the continent experiences reinforces the notion that competitiveness and development of travel and tourism requires an integrated, holistic approach. For instance, most of these issues cannot be tackled by the travel and tourism industry in isolation, but rather require cooperation across different government agencies, public-private partnership and work on national, regional and international levels.

The OECD, UNWTO and WTO have identified the multiple parts of the tourism value chain, which range from transportation and accommodation services to tourism assets, as well as a range of invested agencies and institutions, such as immigration, transport and interior ministries. Exploiting such connections can maximize the development of tourism.

2. Given sub-Saharan Africa’s potential for travel and tourism and the broad range of factors that need consideration, the industry can be used as a rallying point around which policy-makers and other travel and tourism stakeholders push for improvements in areas ranging from structural reform to infrastructure development. This could serve as a stimulant for broader economic development.

Sub-Saharan Africa’s connectivity-based push for travel and tourism competitiveness

Based on the results of the 2019 TTCR, sub-Saharan Africa showed the greatest improvement in international openness relative to the world, especially in regard to visa policy. Eight of the top 20 countries that showed the biggest reduction on visa requirements in the ranking came from the region.

Moreover, 10 regional economies are among the top 20 scorers for more favourable visa requirements. For many economies, increased visa openness is strongly linked to tourism policy. For instance, Benin had the greatest percentage improvement in international openness (133rd to 92nd) in the ranking thanks to reduced visa requirements (122nd to 7th). The country recently announced visa-free access to all African countries, with visa reductions directly tied to its tourism action programme – a programme which is part of a broader integrated development plan.

Aside from national plans, significant progress is being made on the regional level. The African Union Development Agency’s Tourism Action Plan (TAP), the African Continental Free Trade Area (AfCFTA) and the Free Movement Protocol are examples of connectivity-related regional initiatives that identify travel and tourism development as a crucial outcome, recognizing the industry’s ability to have a far-reaching economic impact.

AfCFTA, for instance, is forecast to increase intra-regional trade from 15% to 20% by 2040, with tourism identified as one of five priority sectors for which parties need to submit a market access offering by January 2020. Given that a lack of regional trade agreements is one of the main areas which holds back sub-Saharan Africa’s scores for international openness, initiatives such as AfCFTA could have a substantial impact on regional economies’ long-term travel and tourism competitiveness.

The push for international openness and trade also holds the prospect of helping regional economies close the gap in air transport capacity by encouraging the intra-regional movement of goods and people. Agreements such as the recently signed Single African Air Transport Market (SAATM) reduce barriers for aviation, thus increasing investment in air transport capacity. This is particularly important for sub-Saharan Africa, which has had the second slowest rate of improvement in air transport infrastructure since 2017, trailing the global average scores by nearly 33%. In particular, according to data from the International Air Transport Association IATA, the region’s route capacity is limited, accounting for just 1.8% of the sum of annual scheduled available seat kilometres (a measure of passenger carrying capacity) among economies ranked in the TTCI.

Analysis of the 2019 TTCR reveals that low to low-middle income economies, which account for the majority of sub-Saharan Africa’s states, may see a stronger relationship between improvements in areas such as business environment, international openness and air transport infrastructure and international tourist arrivals than is experienced in high-income economies. However, as shown, addressing these factors often requires a broad, multi-stakeholder approach. Recent regional and national initiatives seem to have kept this in mind.

By: Maksim Soshkin

Research and Analysis Specialist for Aerospace, Aviation, Travel and Tourism, World Economic Forum